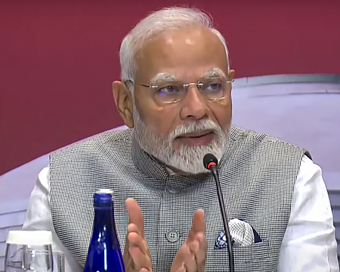

PM Modi visit USA

PM Modi visit USA Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan

Only the mirror in my washroom and phone gallery see the crazy me : Sara Khan Karnataka rain fury: Photos of flooded streets, uprooted trees

Karnataka rain fury: Photos of flooded streets, uprooted trees Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit

Cannes 2022: Deepika Padukone stuns at the French Riviera in Sabyasachi outfit Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss

Ranbir Kapoor And Alia Bhatt's Wedding Pics - Sealed With A Kiss Oscars 2022: Every Academy Award Winner

Oscars 2022: Every Academy Award Winner Shane Warne (1969-2022): Australian cricket legend's life in pictures

Shane Warne (1969-2022): Australian cricket legend's life in pictures Photos: What Russia's invasion of Ukraine looks like on the ground

Photos: What Russia's invasion of Ukraine looks like on the ground Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India'

Lata Mangeshkar (1929-2022): A pictorial tribute to the 'Nightingale of India' PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)

PM Modi unveils 216-feet tall Statue of Equality in Hyderabad (PHOTOS)Hockey India has announced a 54-member core probable squad for the upcoming senior men’s

- Satwik-Chirag return as BAI names 14-strong squad for BWF Sudirman Cup Finals 2025

- Men’s Sr Hockey Nationals to be played in division-based format from April 4

- Mensik denies Djokovic 100th title in Miami final

- KIPG: Son of a vegetable vendor, Bihar’s Jhandu Kumar eyes Worlds, 2028 Paralympics

- Hardik Singh credits hard work and team unity for receiving HI Midfielder of the Year award

Lok Sabha passes GST amendment bills Last Updated : 10 Aug 2018 12:23:38 AM IST

Lok Sabha passes GST amendment bills The Lok Sabha on Thursday passed four bills that seek to amend GST laws which, among other things, seek to simplify the return filing process and increase the upper limit of turnover for opting for composition scheme from Rs 1 crore to Rs 1.5 crore, among others.

The Central GST (Amendment) Bill, Integrated GST (Amendment) Bill, Union Territory GST (Amendment) Bill and GST (Compensation to States) Amendment Bill were tabled in the lower House of Parliament on Tuesday.

Finance Minister Piyush Goyal said the government is making all efforts to simplify procedures and rationalise Goods and Services Tax (GST) rates to create a "good and simple tax regime as envisioned by Prime Minister Narendra Modi".

He said the GST Council has reduced GST rates on 384 items and 68 services in the last one year, and as compliance and revenue collection increases, tax rate on more goods and services will be slashed.

Goyal said that acknowledging the need to simplify return filing process, a committee was set up to study return forms which came up with a single-page return.

"It has now been placed in the public domain for wider consultation."

The Minister said some changes are needed in the law as well to bring in the simple monthly return form, which are being made through the amendment bills.

"Small traders were worried about the reverse charge mechanism and so we decided to make appropriate changes in the law, so as to enable GST Council to decide whether to implement it at all and if yes, then when to implement it. We also deferred it by 15 months to September 2019," he said.

The opposition raised a noisy protest during his response in the Lok Sabha, to which Goyal said the opposition parties are "obstructing and delaying passage of law that is in interest of the nation".

"This is unfortunate. People are watching how you are obstructing the work which is for the welfare of the nation. What message do you want to send to people? Do you want tax rates to be high?

"Congress ministers were involved in the process of framing the amendment bills. And still you are obstructing... People are watching that you act different in the GST Council and entirely different outside," the Minister said.IANS For Latest Updates Please-

Join us on

Follow us on

172.31.16.186